If a corporation has issued only one type, or class, of stock it will be common stock. For common stock, when a company goes bankrupt, the common stockholders do not receive their share of the assets until after creditors, bondholders, and preferred shareholders. Both common and preferred offset account in accounting stockholders can receive dividends from a company. However, preferred stock dividends are specified in advance based on the share’s par or face value and the dividend rate of the stock. Businesses can choose whether or not and how much to pay in dividends to common stockholders.

Determines Voting Rights

To balance out that accounting entry, stockholders’ equity is credited by the same amount. Owning common stock is not just about possibly getting dividends; it also means you get to have a say in big decisions. This could be about choosing the people who manage the company or making decisions on important matters.

Research the Company

The rights and opportunities of a preferred stockholder are essentially different from those of a common stockholder. It is important here to note that stockholder equity may be represented as a grouping of common stock, preferred stock and other items such as treasury stock. If this is the case, you will need to subtract the value of all equity that is not exclusively common stock in order to obtain your desired calculation. Broadly defined, common stock can be thought of as the bedrock of a company’s public offerings. Common shares are issued without promise of dividend to individuals who are interested in partial ownership of the company in question. The owners’ equity section may also show dividends paid to owners or shareholders during the year.

- When an investor gives a corporation money in return for part ownership, the corporation issues a certificate or digital record of ownership interest to the stockholder.

- Common stockholders may run the risk of losing their entire equity in a company because they are paid out last, after bondholders and preferred stockholders.

- This provides a steady income stream, which is especially valuable during market uncertainty.

- This makes preferred stock relatively straightforward to evaluate since its fixed dividends provide predictable returns, making it an attractive option for those seeking steady income.

- One of the most significant drawbacks of preferred stock is that it generally doesn’t benefit from the same level of price growth as common stock.

Analyzing Common Stock in Investment Decisions

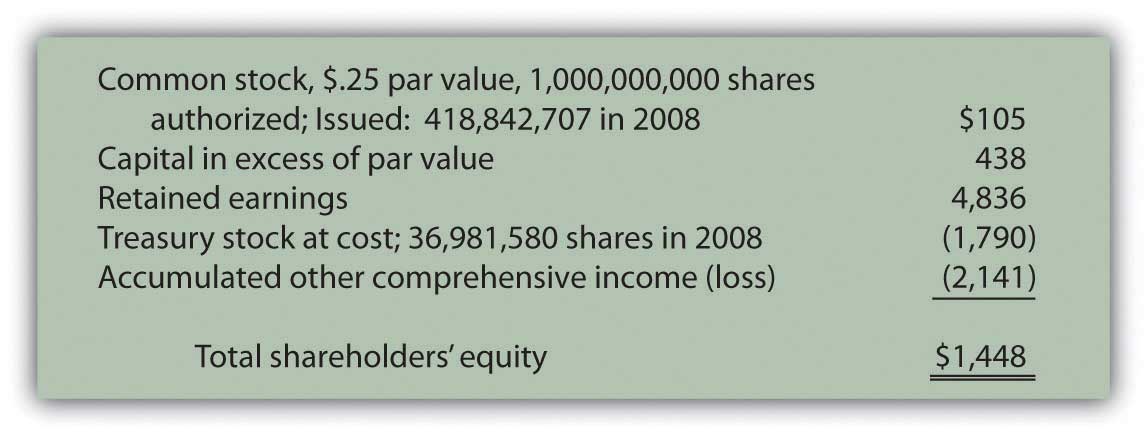

If a state requires a par value, the value of common stock is usually an insignificant amount that was required by state laws many years ago. If the common stock has a par value, then whenever a share of stock is issued the par value is recorded in a separate stockholders’ equity account in the general ledger. Any proceeds that exceed the par value are credited to another stockholders’ equity account. This required accounting (discussed later) means that you can determine the number of issued shares by dividing the balance in the par value account by the par value per share.

But how do we navigate the labyrinthine complexities of common stock calculation? Fear not, for we are about to demystify this process, unveiling the hidden wealth buried within financial statements. These shares allow individuals to help elect a board of directors as well as vote on issues affecting the company. However, common shareholders are last in line when it comes to repayment in the event of corporate liquidation. In order to find the amount of common stock in circulation, you can look for the common stock on balance sheet publications. And the difference between how much it owns and how much it owes is called owners’ equity.

The company records $500 in additional paid in capital in the stockholder’s equity section of its balance sheet. One of the primary reasons for calculating common stock on the balance sheet is to provide financial transparency. The balance sheet shows the company’s assets, liabilities, and equity, which helps stakeholders understand the company’s financial position. The calculation of common stock provides additional information about the company’s ownership structure and how many shares of stock are outstanding. The financial report of a company gives you the scoop on how it’s doing, including the value of the stock per share.

Now companies from China can issue common stock to investors in the United States and vice versa as long as they adhere to the rules governing the exchange. The drawback of common stock ownership for investors is that each stock is accompanied by operational risk related to the venture. It may be possible that the company fails in its mission or does not operate profitably. For investors, common stock enables them to invest in securities that appreciate without significant effort on their part.Common stock dividends can also become an important source of income. Retained earnings are the net earnings a company either reinvests in the business or uses to pay off debt.

This information will typically be included in the element of the balance sheet known as stockholder equity. It may be necessary to subtract the value of preferred stock, bonds and other investment options first as part of a common stock formula, however. (Some corporations have preferred stock in addition to their common stock.) Shares of common stock provide evidence of ownership in a corporation. Holders of common stock elect the corporation’s directors and share in the distribution of profits of the company via dividends. If the corporation were to liquidate, the secured lenders would be paid first, followed by unsecured lenders, preferred stockholders (if any), and lastly the common stockholders. Common Stock is also the title of the general ledger account that is credited when a corporation issues new shares of common stock.

When you own common stock, your return on investment is tied to the company’s performance. If the company does well, the stock price can rise, allowing you to sell at a profit. Common stockholders may also receive dividends, although they’re not guaranteed and depend on the company’s profitability. For each class of common shares state, on the face of the balance sheet, the number of shares issued or outstanding, as appropriate …, and the dollar amount thereof.

Recent Comments